malaysian labour law termination compensation calculation

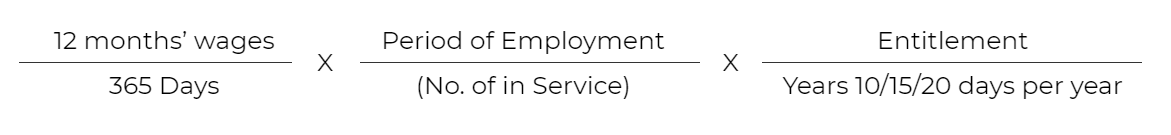

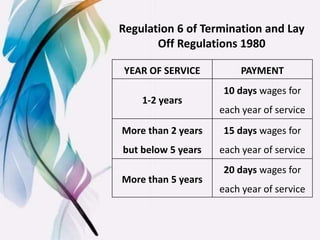

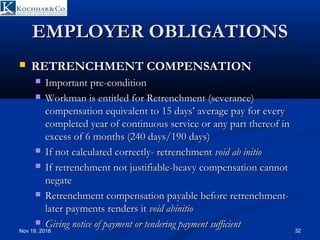

1a Based on the above calculations assuming this employee gross income is RM4500 x 12 RM54000 365 10 days of wages. According to Regulation 6 of the Employment Termination and Lay-Off Benefits Regulations 1980 employees whose monthly salary is RM2000 and below and who falls within the purview of the Employment Act 1955 EA 1955 must be entitled to retrenchment benefits as stated below depending on their tenure of employment-.

How To Calculate Annual Leave Payment On Termination Of Employment Contract Workstem Hr System

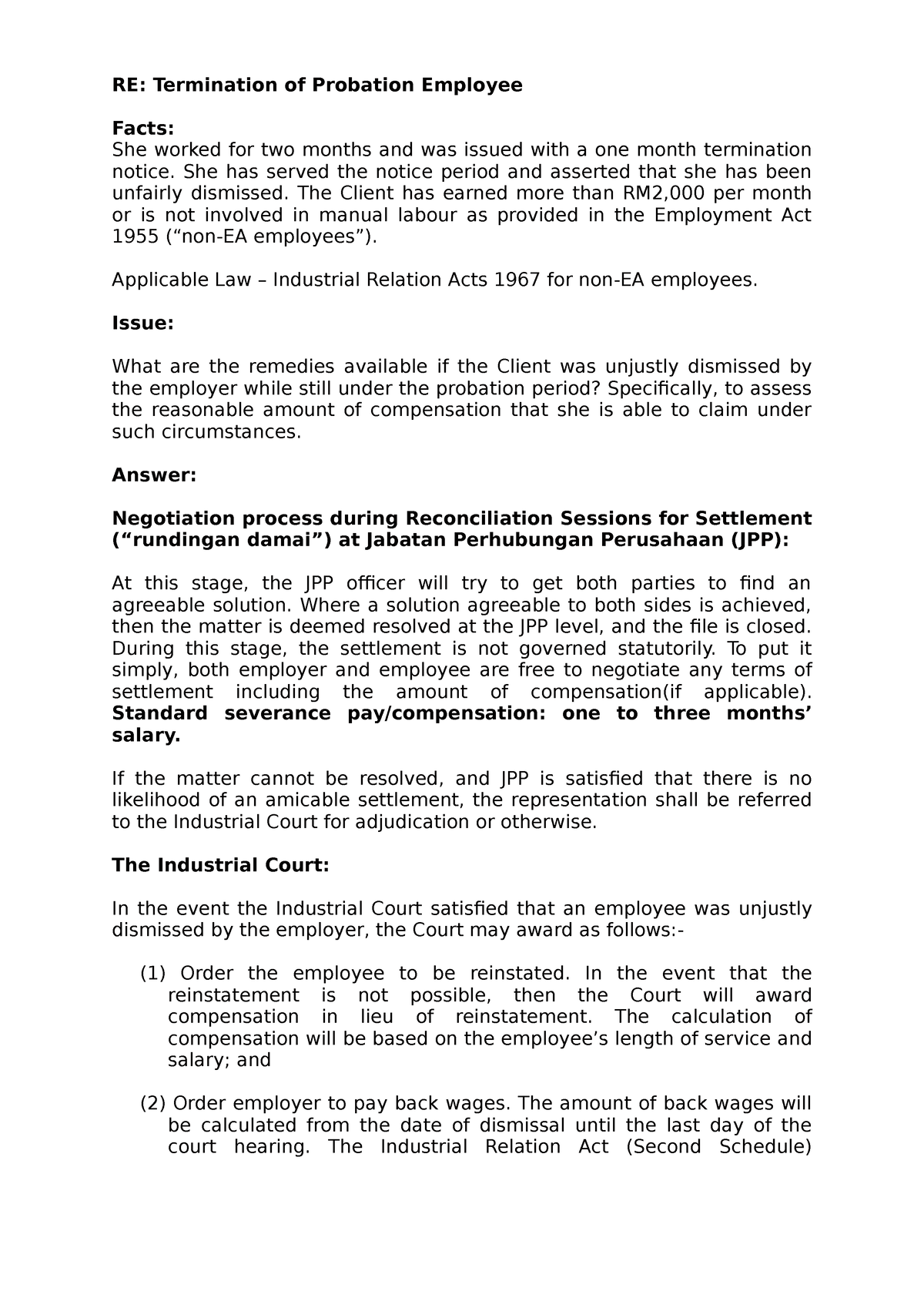

Order employer to pay back wages Back wages are calculated from the date of dismissal until the last day of the court hearing and it shall not exceed 12 months for probationer.

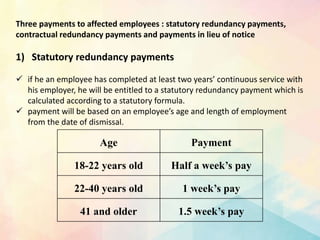

. Unfairly dismissing a senior highly paid employee with many years of service could. For employees who are non-EA-eligible their compensation lies in your hands. First Schedule the EA covers two categories of workers.

Say an employee earning RM 1900 who has worked for 6 years is about to get retrenched. Year x monthly salary 30 days x 15 Compensation. For a VSS or MSS to be valid they must be signed voluntarily.

Home Employee Termination Compensation Calculator. This Act applies to all employees in Malaysia and governs the relations between employers and employees including trade unions and the prevention and settlement of. The calculation of compensation depends on the employees length of service and salary.

RM 3000 RM 2500 RM 5500 EPF Employer Contribution. Therefore if the employee can prove that he has signed the VSS or MSS without his free consent the termination of his employment can be considered as a dismissal. At year 2 and less than 5 years 8 weeks of salary.

2 more than 48 hours per week. More than 5 years 12 weeks of salary. What would be his compensation.

Working hours 1 Employees shall not be required to work more than 8 hours per days. If unfair dismissal is established the Industrial Court may order reinstatement or compensation in lieu of reinstatement and this will include back wages of a maximum of 12 months for a. If an employee is dismissed without just cause and fair procedure or leavesalary being deducted without employees consent then the employer has a risk of being sued and being ordered by the Court to pay a huge amount of compensation.

Unless with boths agreement of termination notice and if not the payment terms will be as written. Employees contribution to Employees Provident Fund EPF Employees contribution to social security organization SOCSO Monthly income tax deduction. In which clause section of EA the calculations of wages are following the calendar days ie.

This could be significant to the employer. RM 6000 RM 2500 RM 8500. The Employment Termination and Lay-Off Benefits Regulations 1980 sets out the formula to calculate termination or layoff benefits payment which shall not be less than a ten days wages for every year of employment under a continuous contract of service with the employer if he has been employed by that employer for a period of less than two years.

2 Non-manual workersClick link for details. The MSS or VSS calculation formula is. An employer must give notice to the employee and show reasonable cause and excuse of dismissal before the termination.

Termination benefits are not payable if within seven days of the change of ownership the transferee offers to continue to employ the employee on terms and conditions of employment that are no less favourable than those under which the employee has been employed before the change occurs and the employee unreasonably refuses that offer. Clearly a dismissal can only be construed if the employee is not released of hisher employment voluntarily. However compensation settlement cannot be paid direct to the wife children or dependants but to be deposited to the Department of Labour concerned.

Malaysian labour law termination compensation is typically awarded based on one months salary for every year of service. RM 5500x 12 calculation by percentage EPF Employee Contribution. However for EA employees the law prescribes that the statutory minimum termination benefits are as follows and pro rata in respect of an incomplete year of service calculated to the nearest.

Failure to notify the Department of Labour in the event of an accident is an offence and the employer shall be liable on conviction to a fine of RM5000 for the first offence and RM10000 for the second offence. 2A Notwithstanding subsection 2 upon the termination of an employees contract of service the employee shall be entitled to take before such termination takes place the paid annual leave due to be taken in the year in which the termination takes place in respect of the twelve months of service preceding the year in which the termination takes place and in addition the leave. Generally an employer is required to make the following deductions from an employees salary irrespective of whether they are an EA Employee or a Non-EA Employee.

365 days from the joining date. In the event of failure to give good reasons for any dismissal the employee may pursue for a claim for unfair dismissal against the employer and obtain compensation for the unfair dismissal. Payment for termination notice.

Employer can use the following calculator to calculate his. Less than 2 years 4 weeks of salary. Industrial Relations Act 1967.

Due inquiry here means the Company must investigate the case and provide. RM 5500 x 11 refer Third Schedule. And Sarawak have their own laws eg Sabah Labour Ordinance and Sarawak Labour Ordinance.

Malaysia Law According to Employment Act 1955 Section 14 Termination of contract for special reasons employer may imply punishment such as dismissal without notice the employee downgrade the employee or impose any lesser punishment as he deems just and fit after due inquiry.

What Are The Types Of Compensation Bonuses And Severance To Include When Terminating An Employee In Malaysia Althr Blog

Omnibus Law Implementing Regulations A Mixed Bag Of Labour Reforms Indonesia Notes

Termination Of Probation Staff Re Termination Of Probation Employee Facts She Worked For Two Studocu

What Is Form Pk L Co Chartered Accountants

Pdf Severance Pay In Selected Asian Countries A Survey

What Is Form Pk L Co Chartered Accountants

Termination Of Employment In Malaysia Legal Smart Malaysia

How To Calculate Annual Leave Payment On Termination Of Employment Contract Workstem Hr System

Employment Law Retrenchment In Malaysia Chia Lee Associates

Retrenchment In Malaysia 2021 What It Is Guidelines And Calculations Mednefits

Service Contract Offer Letter Example Templates At Allbusinesstemplates Com

No comments for "malaysian labour law termination compensation calculation"

Post a Comment